Case Study: Antin Infrastructure Partners

Backed by BNP Paribas Investment Partners, Antin Infrastructure Partners was founded in 2007 by Alain Rauscher and Mark Crosbie.

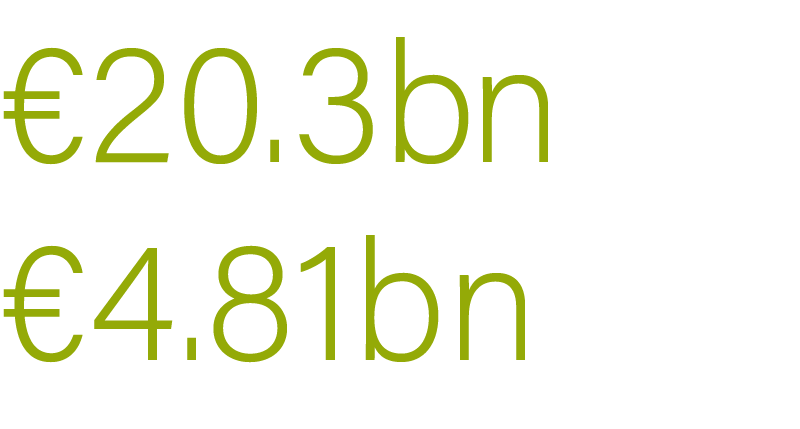

In 2012, the team completed the buy out of BNP‘s stake, enabling the firm to become solely owned by its management. They‘ve since grown into a leading value-add infrastructure private equity firm, comprised of over 40 investment professionals across London, Paris and New York, with AUM exceeding $12B over their 4 fund vehicles.

In 2021, Antin’s management listed the firm on the Euronext stock exchange with a market capitalization of EUR 4.1bn.